The Future of Forex Trading with AI-Based Signal Providers

In the highly dynamic world of currency trading, making the right move at the right time can determine your results. This is where a FX alert platform becomes an important resource.

What Are Trading Alerts?

forex signals provider are market recommendations that offer entry and exit points. These signals often include:

Entry price

Risk management threshold

Profit goals

Trade direction

Timeframe

They are based on technical analysis, fundamental analysis, or a hybrid approach.

Types of FX Alert Systems

There are two common forms of Forex signals providers:

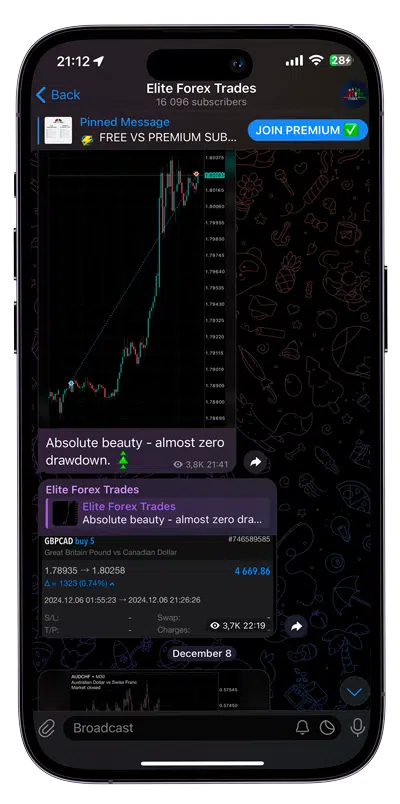

Live Traders – These are market experts who personally analyze charts to create signals.

Automated Providers – These services rely on software algorithms to provide alerts based on code-driven logic.

How Do Traders Use Them?

Signals are sent through:

Email or SMS

Chat-based systems

Mobile apps

Web portals

Traders can either follow them by hand, or use auto-trading that mirror the trades directly in their own account.

Advantages a Forex Signals Provider

Saves time

Helps beginners

Access to expert analysis

Removes emotion from trading

Can increase profits

How to Identify a Reputable Provider

Look for:

Verified track record

Customer testimonials

Accessible history

Strong support

Clear money management

Demo tests

Cautions

While signals enhance trading, not all providers are reliable. Some may exaggerate performance. Traders should always:

Check backgrounds

Steer clear of hype

Practice first

Manage risk properly

Conclusion

A reliable trading alert service can be a valuable ally for anyone trading the currency markets. Whether you’re a newcomer or a veteran trader, using trusted recommendations can improve your strategy. Just be sure to verify credibility before committing.

Comments

Post a Comment